Follow us for more updates either here in our blog or on LinkedIn: https://www.linkedin.com/company/jademond-digital/

Table of Contents

===> 2023 February 21st

This is issue number 19 of our weekly China Internet news for February 13-17, 2023: 1) Xiaohongshu (Little Red Book) launched the website version; 2) ByteDance’s Douyin Livestream is allowed to sell over-the-counter medicine (OTC); 3) JD.COM is no longer allowing “XX-style” used on products titles; Here are the details:

1) On February 9, Chinese social sharing platform Little Red Book (LRB) announced the launch of its web version. Users can access it by searching for “Xiaohongshu.com” in browsers. The move aims to open up a new channel without expanding its business scope. It could help LRB overcome traffic problems and challenges from other platforms such as Douyin (TikTok), which have hurt LRB’s “seeding (sharing)” business. In addition, Baidu, Inc. is now able to crawl high-quality content from LRB, which means that brands on LRB are able to gain traffic from the Baidu search engine. This is a new development to combine SEO and the social market! Source: https://mp.weixin.qq.com/s/p95soOf3Vl-C-GWLEWiiiQ

2) After China allowed the sale of over-the-counter drugs in livestreams, Douyin Ecommerce of ByteDance launched a category called “over-the-counter drugs” on December 7, 2022. The livestreamer must follow strict instructions and support from licensed pharmacists. Excessive advertising is not allowed. Livestreamer Good Pharmacist sold 5-7k orders and gained 240k viewers in its first broadcast. Source: https://mp.weixin.qq.com/s/KeaqViTGXM7_Gyz2KMF8GQ

3) Chinese e-commerce giant JD.COM has banned sellers from using “XX-style” in product titles to combat false advertising. The “XX” here always stands for a famous brand or person. The use of this term has been a common way for sellers to attract visitors, but can lead to infringement, lower product quality and lower consumer trust. JD.com takes measures to regulate the market and protect consumer rights. Source: https://mp.weixin.qq.com/s/c0S50xqYXZLpjQwnxQmcqw

===> 2023 February 7th

- Baidu, Inc. faces real search threat from other internet giants in China; 2) Outbound travel in China grew 640% y/y, according to Ctrip platform; 3) China online market grew steadily in 2022; 4) Domestic civil aviation cargo volume recovered to 80% of 2019 in 2022. Source: http://www.myzaker.com/article/63d4a5ac8e9f0925293981fd

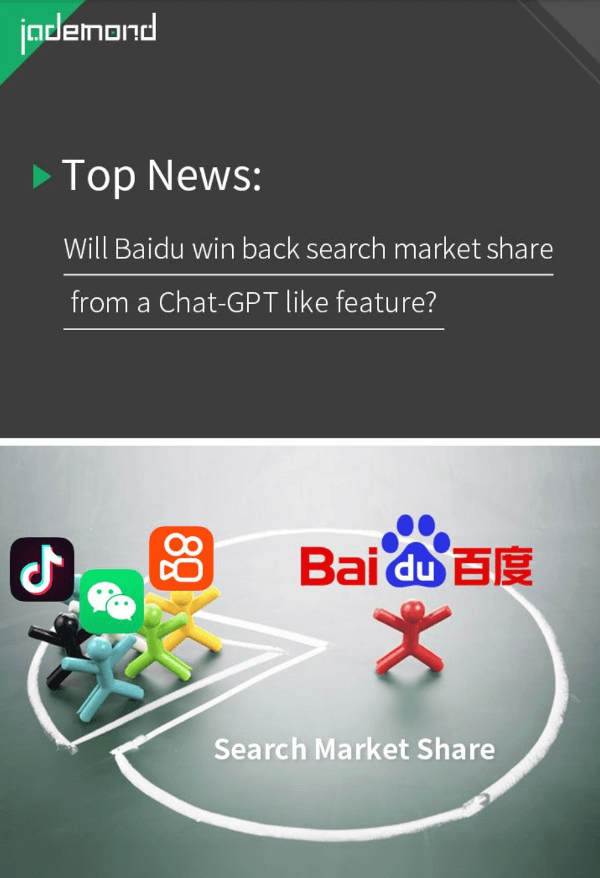

- Baidu, Inc. plans to introduce a ChatGPT-like feature. This move appears to counter search challengers from other internet giants in China. In the past 10 years, Baidu’s search engine market share has always been unshakable. But its leading position is always coveted by social media giants. In 2022, the number of monthly active users (MAU) of Baidu mobile app was 634 million; WeChat’s “Take a search” had 800 million MAU; 抖音 tik tok search 400 million. Kuaishou Technology has reached 250 million. These newcomers are hot on Baidu’s heels. Source: https://www.jademond.com/baidu-liaotian-chatgpt-like-feature/

- Chinese New Year 2023 was the first long holiday after the relaxation of Chinese Covid policy. Overseas tourism performed very well, according to the Ctrip platform, with overseas travel orders up 640% year-on-year, overseas hotel bookings up more than four times year-on-year, and cross-border air ticket orders up more than four times year-on-year. Source: https://baijiahao.baidu.com/s?id=1756138099706972928&wfr=spider&for=pc

- According to China’s Ministry of Commerce, China’s online retail market grew steadily in 2022: The number of live streams on major e-commerce platforms exceeded 120 million in 2022; the import and export of cross-border e-commerce reached RMB 2.11 trillion, a year-on-year growth of 9.8%. Of which, export was RMB 1.55 trillion with an increase of 11.7%, while import was RMB 0.56 trillion with a growth of 4.9%. Source: https://baijiahao.baidu.com/s?id=1756429858782370424&wfr=spider&for=pc

- The cargo volume of domestic civil aviation reached 6.076 million tons in 2022, recovering to 80.7% of 2019; In the first 3 quarters of 2022, the cargo volume of international airlines recovered to 106.1% of the same period in 2019. Source: https://baijiahao.baidu.com/s?id=1754799530726738034&wfr=spider&for=pc

===> 2022 December 12th

This is issue number 15 of our weekly China Internet news for the period from November 28 to December 11, 2022: 1) J&T Express KSA has announced soccer superstar Lionel Messi as its global brand ambassador; 2) JD. COM surges during the 2022 World Cup; 3) bilibili Group has made progress in live-stream e-commerce; 4) Chinese Internet companies’ advertising business seems to recover in Q3 2022; 5) AI painting is catching on in China, but commercial prospects are still unclear; 6) search engine Sougou will discontinue online advertising alliance products this year. Here are more details:

- J&T Express announced on November 26 that Lionel Messi will become its first global brand ambassador. It is the first time a Chinese express company has signed a soccer superstar. J&T is using the FIFA wave to expand its global influence, particularly in the United Arab Emirates and Saudi Arabia, which allowed J&T to do business in early 2022. With Lionel Messi, the super soccer star, J&T has chosen the right brand ambassador at the right time, who will undoubtedly bring great impressions for J&T. Source: https://baijiahao.baidu.com/s?id=1750992697548306437&wfr=spider&for=pc

2) JD.com: https://mp.weixin.qq.com/s/C5Ko-LUgMWTJn-9SQnGI1w - JD.COM’s instant delivery platforms have initiated growth during FIFA 2022. 30% of orders come from the nights. Sales of soccer accessories, coffee beans, and liquor gift boxes have increased more than 7 times year-on-year; non-alcoholic beer is up 240%. Source: https://mp.weixin.qq.com/s/C5Ko-LUgMWTJn-9SQnGI1w

- The bilibili group has announced that its commercial revenues from eCommerce increased by 100% during this year’s Double 11 Shopping Festival. As a content platform, bilibili uses high quality content and KOLs to attract users’ buying interest and achieve eCommerce conversion. Source: https://mp.weixin.qq.com/s/BM5fMHLY3sX7mwfBjyedoA

- According to the third quarter financial reports, some Chinese Internet companies such as Tencent, Weibo and IQIYI, responding to the macroeconomy, advertising business growth. But whether the growth continues need more observation than the economic recovery is getting not so soon after the Covid policy subsides. Source: http://www.myzaker.com/article/63913e7a8e9f096d7b7f1d7d

- Many KOLs and ordinary users in China posted their selfies edited by AI painting programs on social platforms. These selfies won many thumbs up and impressions for the great contrasts between the originals and the edited images. However, there still seems to be a long way to go before AI painting programs are commercialized, as individuals or companies are not willing to pay for them. Source: http://www.myzaker.com/article/638be7c58e9f093e0c59a7af

- Sougou announced that the online advertising alliance (Sogou affiliate) products will be discontinued this year and the website will be closed in early February 2023. Account balances will be settled before February 2023. Sougou was one of Baidu’s challengers in the search field in China. Source: http://www.myzaker.com/article/63884bf0b15ec0260e6f91ce

===> 2022 November 26th

This is issue number 14 of our weekly China Internet news for November 21-25, 2022: 1) Douyin spent CNY1 billion to buy World Cup broadcasting rights; 2) Tencent is unlikely to acquire Blizzard Entertainment’s gaming services in China; 3) ByteDance released a new music app. 4) ByteDance and Ele.me cooperate to try local services in Nanjing; 5) Kuaishou creates World Cup carnival; 6) WeChat Channel boosts advertising revenue from live streams.

- ByteDance’s Douyin spent CNY 1 billion to be one of the seven authorized media companies in China to broadcast the Qatar 2022 FIFA World Cup. By November 22, video views of the #World Cup Talk# theme on Douyin had already reached 17.8 billion. Many soccer stars are invited to set up accounts on Douyin. Source: https://www.sohu.com/na/609121293_121421103

- NetEase’s refusal to renew its contract with Blizzard Entertainment has sparked heated discussions in China. Blizzard might look for other partners like Tencent. But “the game industry is in a downturn this year, so Tencent is unlikely to spend much on signing the contract,” said a Tencent official. Source: https://baijiahao.baidu.com/s?id=1750070314207060305&wfr=spider&for=pc

- ByteDance recently launched a new app called “Tomato Music Free Listening” that offers free audios and targets the sinking market (Tier 3 and 4 cities and villages market). In June 2022, ByteDance released “Soda Music”, a paid app targeting popular music. ByteDance’s 2 music apps have taken a differentiated development. Source: http://www.myzaker.com/article/63730bf5b15ec07edf77feff

- ByteDance agrees with Ele.me, a takeout platform, to set up a mini-program in Douyin. Ele.me can offer local services to Douyin’s 600 million daily active users, from online orders to instant delivery. Nanjing is already a pilot project, enabling over 2,000 stores to offer local services on Douyin. Source: http://www.myzaker.com/article/637996888e9f09220555f545

- Kuaishou has launched a series of fun activities around the World Cup. Users can win money by taking quizzes on the games; famous sports commentators will be invited to comment on the games; some legendary soccer stars and coaches will participate in live streams. Source: https://baijiahao.baidu.com/s?id=1750087485831676394&wfr=spider&for=pc

- Tencent’s WeChat channel is attracting more and more advertisers, especially advertisers for fast-moving consumer goods. Advertiser “Ai Guang” on the WeChat channel announced that its advertising revenue reached CNY53 million from the live stream during the Double 11 Shopping Festival. Source: https://mp.weixin.qq.com/s/TSzXwXCNsYWOvtNs7x7Iaw

===> 2022 November 18th

This is issue number 13 of our weekly China Internet news for November 1-18, 2022: 1) China Unicom and Tencent establish joint venture; 2) Tencent Video Meeting becomes paid; 3) Alibaba invests in online virtual event platform; 4) Alibaba’s Tmall expands its service to offline installation of furniture and appliances; 5) WeChat launches search ads; 6) Douyin of ByteDance was ordered by the court to compensate Tencent for a copyright dispute. Here are the details:

- China Unicom and Tencent have received approval to establish a joint venture to sell content delivery networks (CDN). The Internet industry has already developed into a livelihood infrastructure. In order to ensure national security, it is foreseeable that more joint ventures with state shares will emerge in China’s Internet industry. Since 2017, China Unicom, one of China’s state-owned telecom giants, has been a pilot company for setting up joint ventures with Baidu, Alibaba, JD.com, etc. Source: https://baijiahao.baidu.com/s?id=1748391179331205554&wfr=spider&for=pc

- Tencent Video Meeting will charge users. The monthly subscription is CNY25 per month and CNY288 per year. Tencent Video Meeting was launched at the end of 2019. So far, it already has 300 million users. Source: https://baijiahao.baidu.com/s?id=1748260662974215632&wfr=spider&for=pc

- Alibaba has become a shareholder in Suihuan Technology, an online virtual event service platform founded less than a year ago that received a pre-A round of funding from Tencent and GGV Capital. Suihuan now aims to build a virtual world to support large offline events/exhibitions. Source: https://baijiahao.baidu.com/s?id=1748173305701179811&wfr=spider&for=pc

- Alibaba’s Tmall and Cainiao Logistics announced plans to build a team of 10,000 maintenance technicians to install major electrical appliances door-to-door over the next three years. This indicates that Tmall will expand its capabilities not only in products but also in installation and maintenance services. Source: https://baijiahao.baidu.com/s?id=1747896155191160158&wfr=spider&for=pc

- The WeChat “Take a search” function is approved for advertising. The “Take a search” function, which is supported by 700 million monthly active users, is seeing huge traffic. According to WeChat’s guide, “Take a search” is aimed at small and medium-sized businesses and is pinning its hopes on advertisers placing ads themselves, which seems difficult and unrealistic. Source: http://www.myzaker.com/article/6365aaf78e9f09631f4e50f4

- Douyin of ByteDance was ordered by a court to pay Tencent over CNY 32 million for Douyin users posting Tecent’s exclusive hit drama. Douyin used Tecent’s content without permission and grabbed advertisers’ budgets. Source: https://www.163.com/dy/article/HLLAT6G905198R91.html

===> 2022 November 1st

This is issue number 12 of our weekly #China Internet News for 24-29. October 2022: 1) Alibaba Group’s Tmall livestream courts male users by inviting Smartian founder – Luo Yonghao; 2) Tmall may try to expand its business through Tencent’s Wechat Mini program; 3) Delivery fees for sellers will be increased before and during the “Double 11 Shopping Festival” in 2022; 4) ByteDance’s TouTiao set up an independent shopping channel accessing Douyin eCom; 5) bilibili Group released the shopping function; 6) Meituan announced the entry of Suning. com into the Meituan takeaway app. Here are the details:

- Tmall of Alibaba Group invites Yonghao Luo as KOL to sell products preferred by male users, such as computers, maotai liquor and gold. Luo was the founder of Smartisan Technology Co, Ltd. and claimed to develop a phone that surpasses Apple’s iPhone. He was also a famous teacher of New Oriental Education & Technology Group years ago, known for his lively teaching style. As of 0:10 a.m. on Oct. 25, Luo had already sold about 210 million RMB, an encouraging result. Tmall introduces more KOLs from specialized fields to divert the weights of a few top KOLs. Source: https://mp.weixin.qq.com/s/WPK4B4YUaSkWsR7NcTUj0g

- Tmall has recently launched a WeChat applet called “Tmall Supermarket Xiaodangjia”. Currently, the applet is not synchronized with Tmall Supermarket’s shopping site. This is the first time that Alibaba’s company has introduced a major e-commerce applet on Tencent’s platform (WeChat). Source: ttp://www.myzaker.com/article/634e76328e9f096039230209

- China is on the verge of the “Double 11 Shopping Festival”, with a huge increase in the number of parcels. To ensure the quality of service, delivery companies have increased the fees for sellers. Even before this year’s shopping festival, Chinese delivery fees have been rising steadily because delivery companies found the low prices unsustainable. Source: https://mp.weixin.qq.com/s/ayRyzV-vRZ924v_EYs_ISg

- ByteDance’s TouTiao app has launched a new “shopping” channel. Users can search by keywords, find products in the shopping channel, and place orders. Douyin e-commerce offers products. Now TouTiao has become an important traffic source for Douyin eCommerce. Source: http://www.myzaker.com/article/634e76328e9f095fa64810c8

- Bilibili Group released the shopping function in the live stream area on October 14. In addition to Bilibili’s own products, the goods in the live stream rooms are offered on third-party platforms such as Alibaba’s Taobao and JD.com. Source: http://www.myzaker.com/article/6355daad8e9f0921b9421e8a

- Meituan announced a strategic cooperation with Suning.com, and now more than 600 offline Suning stores are already registered in the Meituan Takeaway app. Suning’s main products are 3C (computer, communication and consumer electronics). These daily necessities products are in line with Meituan’s intention to expand local services. Source: https://mp.weixin.qq.com/s/-uR8Qf15-SqK2G0gRPpckg

===> 2022 October 24th

This is issue number 11 of our weekly #China Internet news for October 17-22, 2022: 1) Alibaba Group’s Alipay enables money transfer to users of Tencent’s WeChat and QQ; 2) China’s 20th National Congress: huge development in eCom and netizen crowd under management; 3) ByteDance launches movie ticket business; 4) Kuaishou Technology changed organization before “Double 11 Shopping Festival”. Here are the details:

- Alibaba Group’s Alipay can transfer money to contacts on Tencent’s WeChat or QQ, but it is not a direct transfer. Users enter the amount to Alipay; a QR code is generated, which can then be scanned by users on WeChat/QQ to receive the money. If the money is not received for more than 24 hours, it will be returned automatically. The maximum single transaction is 2,000 RMB. It should be noted that the money is still deposited with Alipay. Anyway, Alipay and Tencent have taken a first step towards #cooperation in mobile payments. Will there be further integration between these two Chinese internet giants? Let’s wait and see. Source: https://baijiahao.baidu.com/s?id=1746819115863511313

- Chinas 20. Nationalkongress fasste die enorme Entwicklung des Internets in den letzten 10 Jahren zusammen: ①Chinese netizens are 1.032 billion, ranking in world; ②China ranks first in the world in terms of e-commerce transaction volume and mobile payment transaction scale; ③More than 100 laws and regulations on cyberspace #security have been launched. Source: http://news.china.com.cn/2022-08/19/content_78379645.html

- ByteDance has applied to register the trademark “Douyin movie ticket”, and the current status is under review. Unlike Alibaba’s Taobao movie ticket, which targets consumers directly, “Douyin movie ticket” targets enterprise platforms, mainly state-owned enterprises. The services are group purchase of movie tickets and online seat selection. Source: https://baijiahao.baidu.com/s?id=1747015333155972127&wfr=spider&for=pc

- Kuaishou Technology’s e-commerce and marketing departments have changed administrators ahead of the “Double 11 Festival”. This is the third time this year that Kuaishou has adjusted its organizational structures. Now Yixiao Cheng, the CEO of Kuaishou, has become the main person in charge instead of the former “double core” model, and the focus of Kuaishou is shifting to e-commerce. Source: https://mp.weixin.qq.com/s/Tl2_7uwn71s3pgok37J8-w

===> 2022 October 17th

This is issue number 10 of our weekly #China internet news for October 10-14, 2022: 1) Chinese internet companies cannibalize from online to offline; 2) ByteDance’s net loss grew; 3) Meituan is ready to knock on Hong Kong market; 4) Meituan shrinks selection business to focus on core #retail business; 5) ByteDance’s Douyin explores image and text content. Here are the details:

- Chinese internet companies are trying to do business offline: Alibaba Group’s offline supermarket Hema increases sales; ByteDance released offline brokerage Xiaomai; JD.COM Mall opens in Shenyang during China’s 2022 National Day; Tencent sets up offline “QQfamily” stores in second-tier cities. Source: https://mp.weixin.qq.com/s/5zK_OMRQ45ltyQyk-LFIRg

- ByteDance’s net loss for 2021 increased more than 87% to $84.9 billion, according to a financial report ByteDance recently provided to its employees. The net loss resulted from the fair value write-down of convertible bonds in 2020, which exceeded 76%. ByteDance has shrunk its hiring plan and has made small layoffs. Source: https://baijiahao.baidu.com/s?id=1746193040187349231&wfr=spider&for=pc

- Meituan’s meal delivery service is preparing to enter the Hong Kong market and is currently hiring employees. Since 2020, Hong Kong people have a greater demand for meal delivery services due to frequent home-based work. Although Meituan has extensive funds to support price subsidies, can Meituan compete in the meal delivery market in Hong Kong? Source: https://www.163.com/dy/article/HJAG91PU0514CA4V.html

- Meituan is reducing investment in the selection business and concentrating on its core business. The reason for this could be that residents are moving back to the local area during the Chinese National Day holiday. On the home page of the Meituan app, food delivery and other instant delivery services are displayed in the top bar of the home page. Source: http://www.myzaker.com/article/6343e0ff8e9f0979bd2cb505

- Douyin from ByteDance held its 4th developer conference at the end of September and emphasized Douyin’s focus on “images and texts”. ByteDance’s ambitions are not limited to trying to shake Little Red Book’s dominance in “seeding”. ByteDance is trying to make Douyin a super app that will be integrated into users’ daily lives. Source: http://www.myzaker.com/article/63429f7cb15ec003396e8ea5

===> 2022 October 8th

This is issue number 9 of our weekly #China Internet news for September 26-October 7, 2022: 1) Chinese authority regulates online pop-up ads; 2) ByteDance’s Douyin seeks to open up text and image content by conibalizing Toutiao; 3) Kuaishou Technology and ByteDance’s Douyin integrate downward by setting up their own online shopping malls; 4) JD. COM and Alibaba Group are expanding #healthcare layouts; 5) ByteDance is helping Pico explore #VR. Here’s the news detail:

- The Chinese cyber authority has issued regulations to eliminate pop-up windows on the Internet. Pop-up ads with high click-through rates encourage advertisers and Internet platforms to upload vulgar or even illegal content to attract traffic. After the publication of the regulation, many “close” buttons on pop-up windows work better. But how long will the provision work well? Let’s wait and see. Sources: http://www.cac.gov.cn/2022-09/08/c_1664260384702890.htm, http://www.myzaker.com/article/634176918e9f09417544c78f

- Douyin, the core application of ByteDance, tracks the content of texts and images that cannibalize Toutiao from ByteDance. Since Douyin supported text and image creation in November 2021, the number of creators has increased tenfold; users read more than 10 billion texts and images daily; more than 70% of active users read more than 10 texts and images per day. Source: https://news.pedaily.cn/202210/501687.shtml

- After Douyin, Kuaishou Technology also announced that the shopping mall channel will be displayed on the homepage. What makes Kuaishou different from Douyin is that Kuaishou attracts users through down-to-earth live streamers. Kuaishou fears that live streams will soon become obsolete. Online retail stores could build a stable trade and help Kuaishou survive. Source: https://mp.weixin.qq.com/s/7OA6DusFf2saBtsaQVNASQ

- JD.COM and Alibaba Group further explore online sales of over-the-counter medicines, inspired by the “Measures to Monitor and Manage Online Sales of Medicines.” Alibaba claims to build the largest medicine warehouse in Asia; JD.com excels in one-stop services covering all channels and time periods. The trend for healthcare services in China could be digital digitization. Source: https://www.fromgeek.com/liukuang/499999.html

- ByteDance bought Pico, which invested RMB 900 million in VR headsets in 2021. On September 27, 2022, Pico released the new PICO4 VR headset, which weighs only 295g and costs 2499+ RMB. The new headset strengthens the content side with the help of ByteDance. Source: https://baijiahao.baidu.com/s?id=1745126324272602667&wfr=spider&for=pc

===> 2022 September 24th

This is issue number 8 of our weekly China Internet News for September 19-23, 2022: 1) Livestreams from Tmall Global are seen in bonded warehouses; 2) #Douyin eCom partners with JD Logistics to bridge warehousing and delivery gaps; 3) Kuaishou Technology builds ecosystem beyond video; 4) ByteDance launches real estate business; 5) Meitu Inc. Meitu Inc.’s paid subscription and SaaS services are barely sustainable; 6) Content platform Zhihu.com and bilibili Group are struggling. Here are the details:

- Tmall Global and Cainiao Network have launched the “One City One Warehouse” plan. Consumers can “visit” the bonded warehouse in the live streaming rooms to search for preferred imported goods delivered directly from the bonded warehouses. Source: https://mp.weixin.qq.com/s/tw1QkACexrEtI_KXLiPNVA

- Douyin e-commerce’s “YinXuDa” service has been integrated with JD.com Express, offering Douyin users services such as door-to-door delivery. “YinXuDa” is an express service launched by Douyin e-commerce. Source: http://www.myzaker.com/article/63283a648e9f09132012751e

- Kuaishou Technology announced the establishment of the Business Ecology Committee on September 16, with CEO Yixiao Cheng as its chairman. The committee will coordinate and promote the business ecosystem, which includes e-commerce, commercialization, live streaming, local services and recruitment. Source: https://mp.weixin.qq.com/s/Ur4qn-zg5sk3_q0hdo5vJw

- ByteDance’s offline stores Xiaomai Estate have appeared on the roadside in Fuzhou, China. These stores are not directly operated by ByteDance, but they will share data from ByteDance’s real estate information platform “XingFuLi”. Source: http://www.myzaker.com/article/632467cfb15ec07e0712e92b

- Meitu Inc.’s total revenue increased to 339 million in the first half of 2022, with paid VIP subscription and SaaS business accounting for 58%, while advertising revenue accounted for 26%. However, Meitu’s share price was not strongly stimulated by the revenue growth and reduced dependence on ads. Source: http://www.myzaker.com/article/632902598e9f094eaa78b8df

- Zhihu.com’s share price has fallen 90% to $1.25 since March 2021 from a high of $13.58 per share. Net loss was RMB 490 million in Q2, up 52% year-on-year. Bilibili Group’s net loss was RMB 2.01 billion in Q2, up 80% year-on-year. Source: https://mp.weixin.qq.com/s/GNjQW3ZXxwfp6B6uV-AHKQ

===> 2022 September 16th

This is issue number 7 of our weekly #China Internet News for September 12-16, 2022: 1) Alibaba, JD and PDD lead online advertising revenue in Q2. Quarter; 2) Alibaba announced launch date for Double 11 shopping festival; 3) Douyin follows Kuaishou into online recruiting business; 4) Huawei launches new ride-hailing platform that provides data for R&D in automated operation; 5) Alibaba’s Freshippo diversifies its business into “local service”; 6) Douyin Box, the independent eCom app, is to close due to unsatisfactory performance. Here are the details:

- Alibaba Group retained the number 1 position, while JD.COM and Pinduoduo overtook Tencent and Baidu, Inc. to become number 3 in online ad revenue in the second quarter. The first option for advertisers is to sell products directly on e-commerce platforms, as China’s economic growth was only 2.5% in the second quarter, the lowest in recent years. Store owners have more pressure to reduce their inventories. Source: http://www.myzaker.com/article/632175ac8e9f090a3a52023e

- Alibabagroup announced that the #Double11 shopping festival of Tmall and Chinese Taobao 2022 will open at 8pm on October 24. The two waves of sales (October 30 and November 10) will start at 8pm. More support measures will be provided for young people and small and medium-sized enterprises. Source: https://3g.163.com/dy/article/HGOAGOFV0550C0ON.html

- Douyin’s livestreaming rooms allow users to send or receive resumes that are transmitted to Feishu, an official app of ByteDance. The connection between Douyin and Feishu is established, which can increase Feishu’s user base and ByteDance’s influence on office platforms. Sources: https://view.inews.qq.com/a/20220910A02XQC00, https://mp.weixin.qq.com/s/7f37DbZns3FdqWSxCSo

- The Huawei ride-hailing platform Petal Riding was officially launched on September 6. Users can access the platform directly through the HarmonyOS system instead of downloading an app. The platform itself does not offer transportation capacity, while third-party providers offer concrete cab services on this platform. Sources: https://baijiahao.baidu.com/s?id=1743985607306682263&wfr=spider&for=pc, https://mp.weixin.qq.com/s/-hMLASH4LQM8L-R0vjlI-w

- FreshHippo, a new online and offline retail chain from Alibaba, has launched a one-stop life service that includes household cleaning, moving services, digital maintenance, and so on. Users can make an appointment on the FreshHippo APP under “Life Services”. Source: http://www.myzaker.com/article/631abf868e9f09499e6ceeed

- Will ByteDance’s Douyin Box be discontinued? Although the person in charge denied the news, Douyin Box’s performance was not satisfactory – Douyin Box’s peak monthly activity was around 0.1 million in the first quarter of 2022, while Xiaohongshu (Little Red Book) reached 200 million. Source: https://new.qq.com/rain/a/20220909A088JY00

===> 2022 September 9th

This is edition number 6 of our weekly #China Internet news for September 5 to September 9, 2022: Kuaishou, the world’s first platform allowing users to find jobs in live streaming rooms, attracted 250 million job hunters; the new rules for selling OTC online are finally released, giving legal protection to Alibaba Health and JD Pharmacy. Douyin released an open platform, guaranteeing store owners’ data ownership; Douyin is testing the bullet comments feature; Baidu’s continuous investment in AI appears to be paying off. Here are the details:

- Kuaishou Technology is the world’s first platform allowing users to find #jobsin live #streaming rooms. Hisense Group, SAIC Motor, OPPEIN HOME, etc. hired workers on Kuaishou from Aug 26 to 31 in live streaming rooms. CEO Yixiao Cheng revealed that monthly active users of the Job Hunting business in Q2 of 2022 have exceeded 250 million.

Sources: https://mp.weixin.qq.com/s/Kv4v2xFJJhvbbkratYt7TQ , https://baijiahao.baidu.com/s?id=1743293715106485020&wfr=spider&for=pc - On September 6, the Douyin Open Platform was released. Douyin applet, the core of this platform, provides users with general service frameworks and inclusive capabilities. Store owners on the platform will no longer be at risk of losing ownership and control of transaction #data.

Sources: https://www.chinaz.com/2022/0906/1442883.shtml, https://open.douyin.com/platform - On September 1, the State Administration for Market Regulation (SAMR) issued the “Measures for the Supervision and Administration of Pharmacy Online Sales”. Stock prices of JD.COM Pharmacy and Alibaba Group Healthcare rose because issues like what to do and how to solve disputes when selling OTC online will have a #legal basis.

Source: http://www.ipraction.gov.cn/article/zcfg/bwgz/202209/382164.html - Douyin is internally #testing the function of the bullet screen ( #comment popped out on the screen). When playing the video on Douyin horizontally, a “bullet” button is added below the video. You can click it to send comments. Except for text, the bullet screen also supports emojis.

Source: https://baijiahao.baidu.com/s?id=1742914404641736530&wfr=spider&for=pc - Baidu, Inc.’s #ai revenue was 4.2 billion RMB, accounting for 18.1% of Baidu’s core revenue (Baidu excluded iQIYI.com) and 14% of Baidu’s total revenue, according to Baidu’s Q2 financial report. Currently, except for advertising, AI is the largest income source for Baidu.

Source: https://m.thepaper.cn/baijiahao_19765694

===> 2022 September 3rd

This is edition number 5 of our weekly #China online industries insights for August 29 to September 2, 2022. ByteDance’s new search engine complements its #digital map; Douyin gives more content generators traffic and impression; Kuaishou’s quarterly financial report has some good news; Weibo’s new feature may lead to more rational cyberspace; Oriental Selections is trying to be independent of Douyin. Here are the details:

- ByteDance launched a new search engine “Wukong Search”, featured by ad-free search. Now the engine is just for the mobile side. This app is a piece for ByteDance’s digital layout.

Source: https://www.myzaker.com/article/63042d588e9f09708445e095 - Douyin gave traffic and impression to only 1 leading original creator of the video previously. Now, up to 5 other co-creators of the #video can be displayed at the left bottom of the post. Co-creators can get the same traffic and impression as the main original creator.

Source: https://mp.weixin.qq.com/s/raW6BJSZlzLWXlJv4LXkmg - Kuaishou Technology’s domestic business in the second quarter of 2022 achieved a single-quarter profit for the first time, with an operating profit exceeding 93 million RMB.

Source: https://mp.weixin.qq.com/s/k0x4B2VMhUwyvlBOQSXd0g - Weibo Corporation will release a new feature: personal homepages will display public #comment under media or government accounts. Users can not close this feature.

Source: https://baijiahao.baidu.com/s?id=1741843093721544292&wfr=spider&for=pc - New Oriental Education & Technology Group’s ecommerce business is booming so much that it has to launch a standalone app Dongfang Zhenxuan (Oriental Selections). The app is for shops only now without the feature of live streaming. Oriental Selections’ live #streaming is conducted on Douyin.

Source: https://www.myzaker.com/article/63082a7f8e9f0906140c24c9

===> 2022 August 27th

This is edition number 4 of our weekly #china online industries insights for August 22 to August 26th, 2022. We noticed that PDD is tending to start an overseas #business; local life/local delivery seems to be a new #growth point for the Chinese Internet delivery companies; Tencent continues to dig out its own products’ commercial potential. Here are the details:

- According to LatePost, Pinduoduo will release a cross-border #ecommerce platform in the middle of September. The first stop is the US. Its operation style is like SHEIN, taking goods from Chinese manufacturers and selling them aboard. The difference is that this new platform will sell full-category products while SHEIN sells clothes.

Source: https://baijiahao.baidu.com/s?id=1741395864906347269&wfr=spider&for=pc - JD.COM Daojia has been in the top 1 for three years in the Chinese instant #retailing market share, according to partly estimated. The sales volume of JD Daojia and JD Shop Now increased 77% YOY. The Chinese consumer’s demand for instant delivery is expanding from meals to seafood, electronic accessories, medicines, and so on.

Source: https://mp.weixin.qq.com/s/-2MxkdwMOfzPnso5simVYg - On August 19, the online #food delivery service platform Ele.me announced cooperation with Douyin, enabling users to experience local life by “instant browse, instant order, and instant arrival”. According to iResearch, the penetration rate of online local life is expected to reach 30.8% in 2025. Local life services have been regarded as a new growth point by Chinese Internet companies.

Source: https://www.ebrun.com/20220822/496395.shtml - WeChat is manipulating your Moment by collapsing spamming updates while giving more slots to advertisers. WeChat claims that spamming updates in Moments bother users’ tranquil #experience. However, the updates suspicious of spamming messages are more like “sacrificed” for WeChat’s advertisers. This is a mark for WeChat to be further commercialized.

Source: https://mp.weixin.qq.com/s/KFYo7-TWIZtN7y3sDv_OsA - On August 15, MILDOM (DOUYU LTD Japan) announced that it has reached comprehensive cooperation with Tencent Cloud. Douyu is a known game live #streaming platform in China. Live streaming of large-scale game #events needs Tencent Cloud’s solutions of ultra-low latency and intelligent online interaction.

Source: https://news.sina.com.cn/sx/2022-08-16/detail-imizmscv6402358.shtml

===> 2022 August 15th

This is issue number 3 of our weekly China China online industries insights for August 15-19, 2022. We found that the management of Chinese Internet giants is becoming more transparent; Douyin (ByteDance) and Taobao Marketplace seem to be learning each other’s operating style; some Chinese teenagers look like they are not pushing off shoe brands for the elderly.

- Cyberspace #Administration of China(CAC): the basic algorithms of Chinese Internet giants are published. On August 12, 2022, the CAC published the first batch of Domestic Internet Information Service #Algorithm Filing List (August 2022), including algorithm names, main purposes, filing numbers and so on. More details about these basic algorithms are published in the Internet Information Service Algorithm Filing System. Source: http://www.cac.gov.cn/2022-08/12/c_1661927474338504.htm Internet Information Service Algorithm Filing System:

https://beian.cac.gov.cn - Douyin’s #e-commerce mall is more like Taobao and separates goods from content. Previously, Douyin sold e-commerce goods in short videos and live streaming, attracting visitors’ interest to buy. Now Douyin believes that this model has matured and it is time to attract more business that is independent of content. Source: http://www.myzaker.com/article/62fa28558e9f09558c6eba0c

- ByteDance expands the map of new #foodanddrink consumption. Since 2020, ByteDance has invested 9 times in food and beverage, including ingredients, tea, coffee, stews and light meals. Perhaps ByteDance will find more growth points because the growth of domestic advertising, the main source of ByteDance’s business revenue, is slowing down. Source: https://www.thepaper.cn/newsDetail_forward_19459418

- More short videos are displayed on the search result pages of Taobao marketplace. After clicking short videos, users can slide up or down to browse more short videos. Compared with traditional stores, the stores using short videos have another channel to get visitors. The increasing importance of short videos requires better video content produced by Taobao stores to attract customers’ interest. Source: https://mp.weixin.qq.com/s/ZnF_w2W9wJTAto3NlliNFw

- The change of Zulijian shoes is prevalent in Xiaohongshu (Little Red Book, hereinafter “LRB”). Zulijian is a brand of shoes for the elderly in China. After the convenience of shoes has been recognized by the elderly, Zulijian is trying to attract young customers. As LRB is a young and #entertainment sharing platform, Zulijian encourages LRB users to transform and present the shoes in the aesthetic style of youth. Source: https://mp.weixin.qq.com/s/tfTeV-8Ok8jhxgvCA5L2fQ

===> 2022 August 9th

This is issue number 2 of our weekly insights into the Chinese online industry from August 8-12, 2022. This week, we recorded some remarkable news from e-commerce, especially the two phenomenal apps in China – Douyin and Xiaohongshu (Little Red Book, hereinafter “LRB”): Douyin Group (ByteDance) is moving towards self-research chips, expanding local-life services and encouraging KOLs to take social responsibility; LRB is further commercialized to introduce camping activities and keep the risky function – voice chat space. JD Group plays up its advantages in logistics and refines after-sale service for car phones. Here are the details:

- Douyin from ByteDance recruits experts for chip research and development. In 2020, 60 million videos were uploaded to Douyin, which is a test of Douyin’s algorithm and computing power. Douyin’s chips are customized for its own needs and not for commercial use. In addition, U.S. restrictions on chips for China put pressure on Douyin to develop its chips. Source: https://baijiahao.baidu.com/s?id=1739920028289361268&wfr=spider&for=pc

- Douyin by ByteDance is attacking Meituan’s core business through Douyin Local Life. From Douyin Stores Visits to Group Buying Delivery, it is trying to shake up Meituan’s two core businesses – Meituan Stores Arrival and Home Arrival. Douyin founder Zhang Yiming sees great potential in location-based services (LBS). Source: https://mp.weixin.qq.com/s/QbDTLH4AjGy5bHbxOnO8Mg

- Douyin e-commerce is launching the “Firefly Project” on August 6. This project encourages livestreamers to sell goods related to books, agricultural products, and cultural products for a small commission, thus spreading knowledge, revitalizing villages, and preserving #culture. Participants can receive credits and traffics. Source: http://www.dzwww.com/xinwen/jishixinwen/202208/t20220809_10649489.htm

- Xiaohongshu uses camping as a breakthrough to enter the #travel business. Since June 2022, LRB has registered trademarks such as REDVILLAGE and REDCAMP. They are currently still under review. From July 27 to August 5, LRB conducted a “Summer Camping Plan” to promote the “Camping Coupon” product. Source: https://mp.weixin.qq.com/s/-n-aOiw1FZ1PRfhqqWD-ug

- The Xiaohongshu (voice chat room) feature copies the outdated Clubhouse, whose followers have been removed from the app stores. This feature is a multi-user public voice chat that has been in the internal testing phase for almost a year. Such a long period is not common in the Chinese Internet industry. Apps like Clubhouse always face security risks and regulatory compliance. Source: https://mp.weixin.qq.com/s/CqtaGOwD0tqzEFQLZpT2jQ

- JD.COM #logistics is further involved in the #supply chain of after-sale services for automobiles. For a long time, automotive companies have struggled with high inventory levels, slow turnover and expensive transportation costs for after-sale products. To alleviate these pain points, JD Logistics has increased the speed of transportation and distribution of fittings by leveraging its powerful model of warehouse and allocation integration. Based on JD’s extensive marketing data, user demand can be more accurately estimated, making valve delivery more flexible and agile. Source: https://www.163.com/dy/article/HE0FTCTS0527889O.html

===> 2022 August 5th

This is edition number #1 of our weekly China online industries insights for August 1st to August 5th 2022. This week in China’s ecommerce industry was quite turbulent. We saw changes in how Xiaohongshu wants to define their target audience, Douyin is asking their users for more natural language, Bilibile takes action against cyber bullying, Baidu is yet again entering a new market and Searchengines like Baidu and Sogou made a change to more security. Here are the details:

- bilibili Group releases a set of functions to prevent and punish #cyberbullying. Users can complain by clicking the “Personal Character Attack” button. In addition, many KOLs on the platform have voluntarily signed proposals to prevent cyber violence and protect the community.

Source: https://baijiahao.baidu.com/s?id=1738773429354545787&wfr=spider&for=pc - Douyin has published a list of frequently used non-standard words. Using the standardized version in regular promotional videos is not considered a violation of the rules. For example, many KOLs used to speak “price” as “rice” in videos or live streaming rooms to avoid supervision. Douyin clarifies that the normal use of “price” is allowed.

Source: https://www.cet.com.cn/wzsy/kjzx/3212780.shtml - Xiaohongshu (Little Red Book, hereinafter “LRB”) is trying to attract more male users. Currently, most LRB users in major cities are women. LRB is trying to attract their boyfriends or husbands as new users by adding more areas such as #sports, games and digital devices.

Source: https://baijiahao.baidu.com/s?id=1739242442848902544&wfr=spider&for=pc - 4th AutoNavi and Baidu, Inc. map have launched a deal in #real estate. When users enter the name of a property into these maps, they can browse its square footage, prices, nearby used properties, and street maps. Map apps are more like channels that drive traffic to real estate companies. Now real estate agencies may place ads on AutoNavi Map.

Source: https://baijiahao.baidu.com/s?id=1740051642255545983&wfr=spider&for=pc - On August 1, 2022, some users found that Baidu and Sougou had abolished the “snapshot” buttons. Snapshots or cache can show the contents of deleted websites and can be abused by lawbreakers for illegal advertising. When #search engines were slow and unstable, snapshots were used to improve user experience. Given the risks and low demand for snapshots, Baidu and Sougou have discontinued this feature.

Source: https://baijiahao.baidu.com/s?id=1740059214698023758&wfr=spider&for=pc

Follow us for more updates either here in our blog or on LinkedIn: https://www.linkedin.com/company/jademond-digital/